Tucked away inside a 131-page economic statement, is a short section that lists the federal government’s guidelines and expectations for financial institutions that could help Canadians at risk of losing their homes.

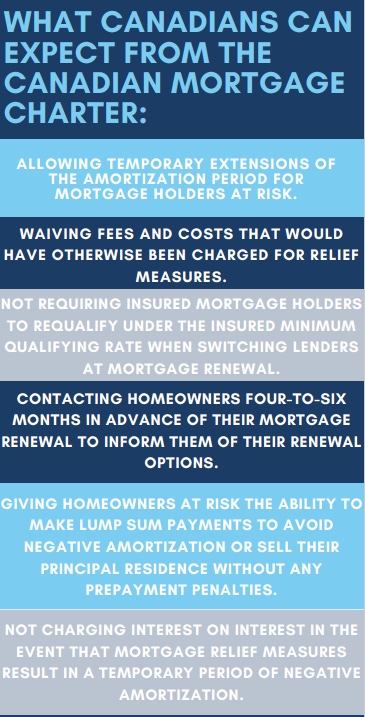

The section, called the Canadian Mortgage Charter, outlines non-binding recommendations to ease financial stress due to increasing mortgage rates.

Housing-industry analysts say the charter, which compiles existing initiatives into one document, could put pressure on financial institutions to ease the strain for homeowners who are in mortgage trouble. However, since it’s a non-enforceable package mainly comprised of existing measures, they assert that it probably won’t make a lot of difference in the lives of homeowners struggling to pay their mortgages.

“I think it’s kind of the government saying, ‘OK, given the situation we’re in here are the ground rules that we want you to operate under,’” said Jason Burggraff, executive director of the Greater Ottawa Home Builders’ Association.

The stress of being able to afford a mortgage is a growing problem for many Canadians. Mortgage Professionals Canada reported in late November that 73 per cent of mortgages are uninsured, and one in five Canadian mortgage holders are up for renewal in the next year.

In a recent survey, the Angus Reid Institute found that the number of mortgage holders struggling to make payments has escalated this year. The October data showed 15 per cent said they found paying their mortgage was “very difficult,” a figure that doubled since last March.

Burggraff said the charter could create a framework to help those in the housing market.

“We want homeowners to have every reasonable opportunity to stay in their homes, even if they experienced financial distress,” he said. “It’s infinitely better for everybody: for banks, for the government, for the general population to stay in our home if at all possible,” he said.

While some may feel the charter is a step in the right direction for mortgage owners, others disagree.

“Overall, I think it’s a political stunt,” said Robert McLister, an interest-rate analyst and mortgage planner. “I think it doesn’t deliver much new value to Canadians.”

Despite his concern, McLister noted that there’s a new, potentially helpful element in the charter that financial institutions should contact homeowners four-to-six months before their mortgage renews. “That was one new thing I noticed,” said McLister, who is a contributing writer for The Globe and Mail.

While the Canadian government asserts in the charter that they will closely monitor financial institutions’ implementation of and compliance with relief measures, McLister shares the concern that the charter is nothing more than a reiteration of already existing provisions.

The federal government wants “to make it look like they’re doing something positive,” he said. McLister added that many of the provisions had been previously announced but were packaged into a charter because it “has connotations of protecting people’s rights and looking out for the little guy.”

Another concern is whether the charter can have a legitimate impact on the average Canadian. Housing and mortgages “may be the number one issue in the mind of Canadians and the government is responding to that in any way they can,” said Dan Eisner, CEO of TrueNorthMortgage, a firm that helps clients find the best possible interest rates.

Eisner said he thinks clients would look favourably at the charter. “I would imagine they would see this as a good thing, the government’s responding to their worries,” he said.

Eisner said he envisions the charter as a way that Canadians can feel both heard and supported by the government, even though it is out of federal jurisdiction.

Burggraff, however, said the charter acts as an informal agreement between all parties involved in the mortgage process.

For Burggraff, the charter addresses financial institutions, and the government’s expectations that they will use the document as a guide to help people afford their mortgages, thus allowing Canadians to keep their houses.

Despite this, Eisner, Burggraff and McLister emphasize the charter is not legislation and cannot be enforced as such.

Instead, they say this is a way to remind Canadians what they can do about their mortgages, and for the federal government to remind financial institutions, mortgage brokers and those with mortgages that there are ways to remedy — if only temporarily — certain issues caused by mortgages because of the ongoing housing crisis.

To that end, the charter may prove useful to those facing challenges, as it reminds those involved in the process that there is a uniting factor and everyone can be “a bit more flexible in the difficult economic situation we’re finding ourselves in, especially with high interest rates,” Burggraff said.