The recent recession has put a spotlight on the bank accounts of individuals and how much we save. As governments cut spending to get their own deficits down to an acceptable size, the average Canadian’s debt level has hit new highs – according to the latest data from Statistics Canada, Canadians owe $1.50 for every dollar they earn. This ratio is among the highest in all OECD countries and has been increasing since the global financial crisis in late 2008.

Mixing money and math class

At the same time, more is being done to teach Canadians, young people included, about how to save money, invest, and manage debt. In September 2011, elementary and high school students in Ontario learned about taxes, credit cards, advertising and investing for the first time as part of their formal curriculum. The Ontario Ministry of Education reported in 2010 that there was a growing need for this kind of personal finance education as the financial decisions required of the average person become more complex. British Columbia has had a similar financial literacy curriculum in place since 2004, and the government of Manitoba plans to launch a program based on the others in the next few years.

But while these lessons are being taught in at least some provinces today, today’s twenty-somethings are facing decisions their formal education did not address.

Perhaps that is why today’s young adults are a focus of the federal government’s Task Force on Financial Literacy.

Financial illiteracy skews younger

Established in 2009, the task force’s work drew on a Statistics Canada report from the same year that noted young people are struggling to make ends meet, choose the right financial products and plan for their financial future.

The task force reported to Parliament in February 2011, and seven of the 30 task force recommendations specifically mention young people and ways to address their unique financial vulnerabilities:

- There should be counselling and education provided to every student who applies for a loan through the Canada Student Loans Program.

- Employers should incorporate financial literacy training into current training programs. The task force noted “early work experience and career development are ideal points in the life cycle when money management and financial planning may be most salient for youth.”

- Financial-service providers should take advantage of “teachable moments” based on specific life events such as having a baby or changing careers. People aged 20-30 are likely to experience many of these life changes.

- The Canadian government should make financial literacy programs eligible for funding under the Youth Employment Strategy (YES) programs.

- Programs for financial literacy should pay more attention to behavioural biases. The report notes that young people “have a tendency to discount the future.”

- The task force believes there should be a single-source website for youth and students to convey information related to budgeting for school, getting a first credit card, and saving for university or college.

- The government and private sector should encourage young people to learn about financial literacy through awards and contests.

None of the task force’s recommendations have been implemented yet, but one of the task force members, Evelyn Jacks, says she is confident the recommendations will make a difference once they are put in to action.

“Financial literacy really has a lot to do with life events,” says Jacks, who is president of the Knowledge Bureau, a financial education provider and publisher. The task force’s recommendations take those life events in to account, suggesting that money management skills be developed at specific times in a young person’s life, such as going to university or college and getting a student loan, and during early work experience or a summer job through YES. Jacks believes this is a good way to make financial literacy relevant to young people.

“If you’re still living at home being cared for by mom and dad even through you’re 25, you don’t have the same needs as someone 10 years later who has got a mortgage and two babies,” Jacks says.

Taking to the web

The task force’s recommendations are meant to be carried out in collaboration with existing efforts to teach Canadians about money management, Jacks says.

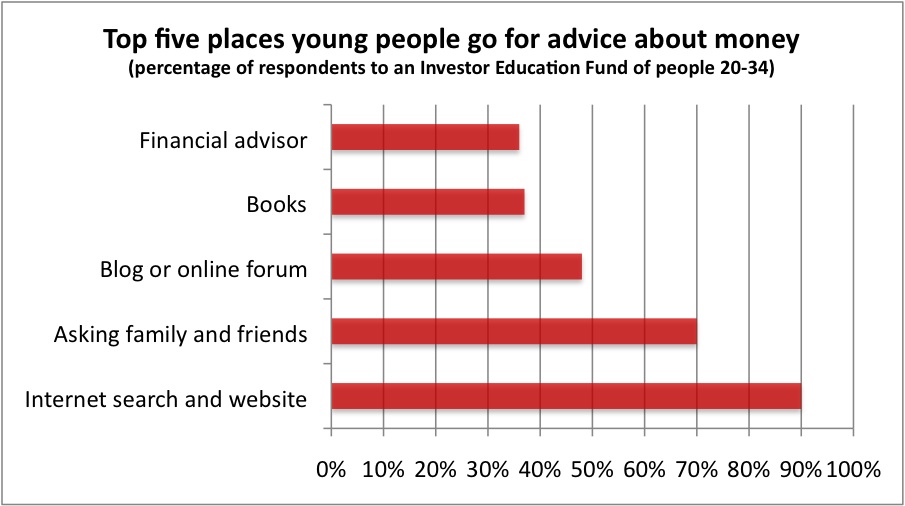

Those include the website getsmarteraboutmoney.ca, created by the Investor Education Fund, which receives financial support from the Ontario Securities Commission. The site features an abundance of information about investing, saving and taking on debt, as well as blog posts by financial writers.

Tom Hamza, president of the Investor Education Fund, says his website borrows a lot from marketing concepts to get people interested in learning about personal finance.

“You have to break down all the barriers you can to have people use the information,” he says.

Rather than simply explain it’s better to pay off credit cards in full each month or show a hypothetical example of how one person saved a lot more money for retirement by starting to contribute to the RRSP early in life, people can use calculators on getsmarteraboutmoney.ca to assess their own unique situation.

Another advantage to online finance tools is that users can do this anonymously and conveniently from home rather than going to a bank or financial adviser.

“Only when you get the right information in the right way at the right time do you have a chance of getting people to change their behaviour,” Hamza says.

He knows the Investor Education Fund’s efforts to change behaviour run up against the mission of other groups, such as banks offering credit cards, who want people to spend, spend, spend.

“We have to be better than them,” Hamza says.

He echoes Jacks’ sense that ‘teachable moments’ are the key to reaching people. Getsmarteraboutmoney.ca organizes information on its website by life event, such as having a baby, buying a car, and life after high school.

“Only when you get the right information in the right way at the right time do you have a chance of getting people to change their behaviour.” – Tom Hamza

“If you want to be talking to people, you’ve got to be talking to them when they immediately have an interest,” Hamza says. “In university and post-graduate studies when people have debt is a good time.”

Hamza says he knows young people looking for help with their money will look at a variety of websites. The Financial Consumer Agency of Canada also posts reliable information about mortgages, credit cards, and loans and there are other not-for-profits and individual bloggers offering up financial information and advice.

“It’s almost like they will aggregate and average [the information they find],” Hamza says.

That’s why it’s important to make the correct information easily accessible. Investor Education Fund plans to partner with the Financial Consumer Agency of Canada to offer online courses soon. The IEF and FCAC has already developed a workshop for post-secondary institutions called ‘The Financial Basics’ with the Toronto Star’s financial columnist Ellen Roseman.

Read on– Next Chapter: The trick: Behaving like a saver