I nstead of introducing anti-dumping duties, the heads of state of the six EAC countries decided to use other trade measures to protect their domestic textile manufacturing. This involved hiking tariffs on the import of second-hand clothing as well as announcing their intention to completely phase-out second-hand clothing by 2019.

In June 2016, Tanzania doubled the import tariffs on second-hand clothing from 20 cents per kilogram to 40 cents per kilogram. Rwanda took a much stiffer approach, increasing the tariff from 20 cents to $2.50 per kilogram. The clothing recycling industry in Canada and the U.S. has condemned the move, arguing that the closure of EAC markets to second-hand clothing exports has negatively affected its billion-dollar industry.

Secondary Materials and Recycle Textiles Association (SMART) represents small and medium-sized companies across the U.S. and Canada who are involved in using, converting and recycling pre- and post-consumer textiles. Among those members are for-profits like Value Village and brokers like Bank & Vogue. These companies employ approximately 200,000 people across Canada and the US.

Their concerns over the proposed ban prompted them to lobby the United States Trade Representative (USTR) and Canada’s senior advisor of Pan-African Trade, Philip Halliday, to intervene. Halliday’s office declined to confirm SMART’s statement that Canada was in negotiations with the EAC regarding the tariffs introduced on second-hand clothing.

Nathan Gashayija, former director general of the Ministry of Trade, Industry and East African Affairs explains how the Rwandan government plans to phase-out second-hand clothes. (Credit: RTV)

Impact to Canadian and American jobs and charities

Jackie King, executive director of SMART, argues the tariffs have acted as a de facto ban and are negatively affecting her members in the private sector.

“We did a survey of our membership and found that just under half of respondents reported having to reduce staffing by about 25 per cent or more,” she said.

It’s possible other factors could have contributed to the decline in staffing throughout the industry as commodity markets, especially second-hand clothes are particularly susceptible to shocks such as policy changes and product availability.

SMART says if the EAC were to follow through with a ban it could adversely affect charities, graders and brokers across the U.S. and Canada because of how interconnected the textile recycling industry is.

“Some of the materials that our members collect here might go to another country first before they go to these East African countries because a lot of the sorting and grading is not done here in the U.S.,” King said.

“They may get shipped to Canada, so it impacts the whole chain within the textile reuse and recycling industry.”

In 2016, Canada was one of the biggest importers of used clothing from the U.S., according to UN ComTrade data. However, as King points out they are often graded and then re-exported.

Value Village has reported feeling an economic hit from the EAC’s penalties on used clothing imports that have forced them to re-evaluate their business model according to Tony Shumpert, vice president of recycling and reuse for Value Village.

“What we have chosen to do is focus on efficiency inside of our stores to compensate for that,” Tony Shumpert said, “figuring out how to drive merchandise in our stores that has a higher yield.”

At the moment, he says Value Village is still able to support charities by purchasing their used clothing donations.

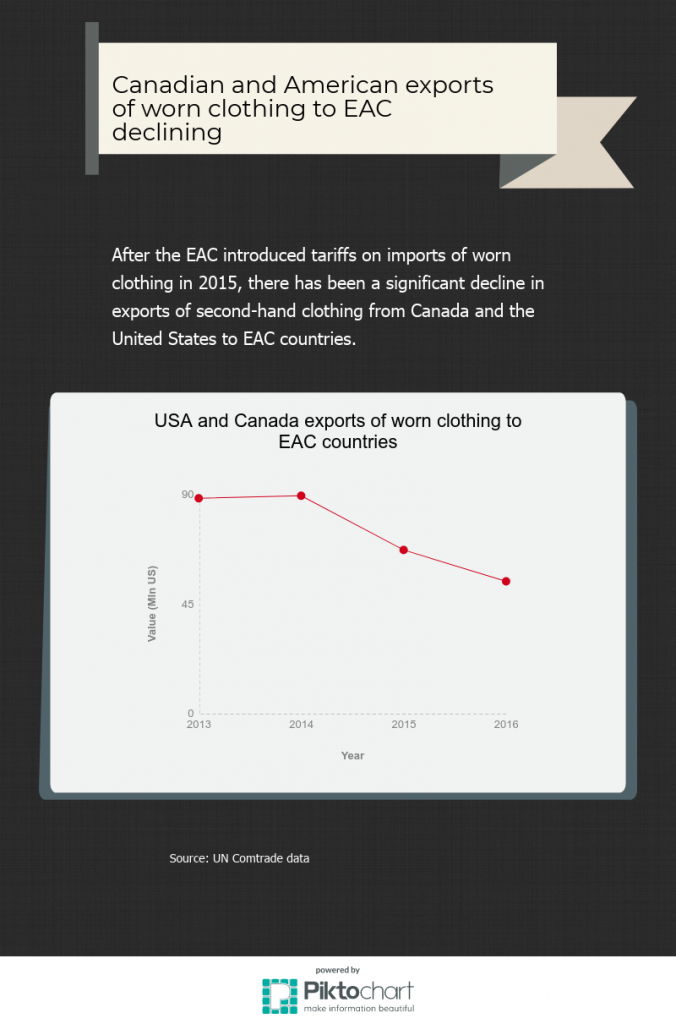

So far, exports of second-hand clothing from Canada and the U.S to EAC countries have already dropped by 20 per cent since tariffs were introduced.

Interactive

Click on the image for the interactive version. Scroll over the points on the graph for figures.

SMART estimates the EAC makes up about one-quarter of the global reuse market for second-hand clothes. King claims that without the East African market, her members either cease buying clothing donations from charities or it would force them to pay out less money.

In late June 2017, SMART petitioned for a review of AGOA benefits for Rwanda, Tanzania, and Uganda to see if the EAC’s tariffs affect their eligibility. Kenya is exempt from this review because it agreed not to implement higher tariffs on second-hand clothing and denied there ever was going to be a ban after pressure from the U.S. Kenya in comparison to other EAC countries benefits the most from AGOA since they have a healthy textile industry. However, Kenya is also working on a plan to shift away from second-hand clothing.

“The Kenyan industry and Kenyan government believe that they could sell their products in the local market if they were not facing competition from used clothing,” Ryberg said.

SMART argues that the EAC’s tariffs discriminate against U.S. companies who export used-clothing. However, Ryberg says this argument is flawed.

“You could make the argument that these aren’t even U.S. goods,” Ryberg added.

“These are mostly Chinese goods that are being re-exported to Africa.”

SMART’s petition gained traction with the USTR, which has temporarily suspended AGOA benefits to EAC countries like Uganda, Tanzania and Rwanda while the review is underway. USTR gave the EAC an ultimatum in February 2018 to back down on their stance on second-hand clothing or face consequences.

Despite the threat of losing their AGOA benefits, EAC countries like Tanzania, Uganda, Rwanda, and Burundi that have small domestic textile manufacturing industries, continue to stand by the decision to discourage imports of second-hand clothing. However, as a report in the UN Africa Renewal, points out Tanzania, Uganda and Rwanda are not currently reaping huge benefits under AGOA because their textile products are being undercut by goods that are more cheaply made by dominant textile-producing countries and thus duty-free access alone is not enough to give them a competitive advantage.

At the EAC Heads of State Summit in Kampala, Uganda on Feb. 23, 2018 they reiterated their desire to prioritize the development of a competitive domestic textile and leather sector.

[documentcloud url=”https://www.documentcloud.org/documents/4412488-EAC-Communique-Feb-2018/annotations/411194.html”]